The victors in the recent election have declared it open hunting season on the rich, which they evidently believe will solve our spending problems. Tax hikes everywhere are aimed at the most productive members of society. Willie Sutton was once asked why he robbed banks. He responded, “Because that’s where the money is.”

Tax planning is critical for middle-income families. With all the changes going on, it is easy to get caught in the crossfire. Defer taxes for too long and you might miss opportunities to realize income in a lower tax bracket.

For example, consider Mrs. Brown, a widow who lives in California. Having spent her entire adult life in the same house, she is now selling and moving near her daughter. Simply by selling her home she finds herself in the top 1% of adjusted gross income. Yes, she gets an exemption, but the gains are far more than that. Most of them are inflated by loose-money government policies since 1970. Her capital gains are taxed at 15% federal and 9.3% state. California makes no allowance for capital gains being taxed lower than income.

Starting next year Mrs. Brown could be taxed at 23.8% federal and 13.3% state for a total tax burden of 37.1%. Being taxed on inflation means she might have actually lost purchasing power after paying her taxes.

Mrs. Brown will be punished for realizing so much capital gains. Her Social Security will be taxed at a higher rate. Her Medicare insurance payments will spike. Tax planning requires planning and foresight even for middle-income Americans.

Tax planning is even more important for those with a higher net worth. Why tax the rich? Because they have the money. Redistribution only works so long as you can tax other people’s money. And a dollar saved on taxes is worth more than a dollar earned. If you earn another dollar, they will just tax you again.

The elections have put the rich on notice. If you aren’t able to run zigzag around tax planning, you will be easier for our legislative snipers to pick off. Don’t just stand around waiting to get hit with tax cuts targeted at the rich. There is still time between now and year-end for massive tax planning. Here are seven strategies to hide and stay clear of the crossfire.

1. Convert the optimum amount of your IRA to a Roth before the end of the year. Use segregated Roth accounts. You can always recharacterize or unconvert any amount you decide you shouldn’t have converted in the first place.

2. Plan for Roth conversions during your gap years. Between retirement (age 65 or 66) and when you have to start taking required minimum distributions (age 70 1/2) you may have little or no income. This is another tax-planning opportunity.

3. Place your investments in the appropriate investment vehicles. Understand which assets belong in a Roth, taxable or traditional retirement account. This can boost your after-tax returns by as much as 1%.

4. Consider postponing your charitable giving until January 2013. This will increase your taxable income this year while your rates are low and decrease your taxable income next year when the rates are higher. Whichever year you do your charitable giving, gift appreciated stock.

5. Analyze your unrealized capital gains before the end of the year. Capital gains tax changes are very significant and quite complex. They are also changing extensively this year. In some cases there is an optimum amount of capital gains to realize before the end of the year. In other cases you should not realize any. There is much to be gained by careful tax planning for your specific situation.

One strategy for those with taxable income under $70,700 is to purposefully realize some capital gains this year. Any gains that come in under that taxable income limit are taxed in 2012 at a rate of 0%. This is the last year such a rate is offered because the Bush tax cuts will expire at the end of 2012.

6. Fund tax-sheltered accounts. College 529 accounts grow tax free, and withdrawals for qualified educational expenses are also free of tax. Health Savings Accounts are even better. Contributions are made pretax, and withdrawals for qualified medical expenses are free of tax.

Most importantly, fund your Roth accounts to the maximum extent possible. Money saved and invested in a Roth account is like being lowered in the first lifeboat off the Titanic. You can save in a Roth IRA, as part of a Roth 401(k) or in a nondeductible Roth that is then converted to a Roth IRA. Talk with your CPA to determine which choice is best in your situation.

7. If you run a small business, consider employing your dependent children. This strategy reduces the income taxed at your high marginal rate and realizes income at your children’s lower marginal rate. If your children then pay for some of their own expenses, the family is paying with dollars that haven’t been taxed as much. For example, children can buy their own clothes, electronics, food, school supplies, car insurance and gasoline.

Last year’s tax return may give you additional ideas. Discuss your return with a tax-planning specialist. Just because the electorate is out to redistribute more of what you’ve produced doesn’t mean you should make it easy for them.

![]() This article is one of our most popular posts.

This article is one of our most popular posts.

6 Responses

David John Marotta

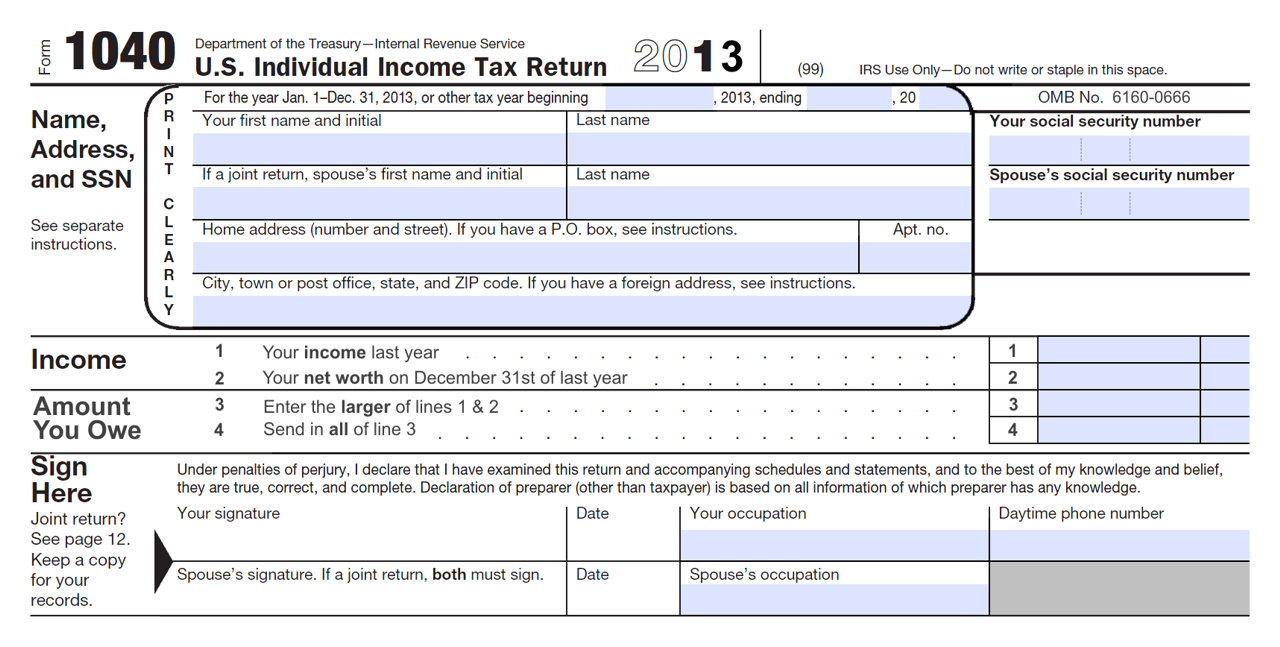

For those of you who expressed an interest in the full image used for this article, here it is:

Skerdi Kostreci

David:

Good article. The list can be extended somewhat, especially for business owners.

You say:

5. Analyze your unrealized capital gains before the end of the year. In some cases there is an optimum amount of capital gains to realize before the end of the year. In other cases you should not realize any. There is much to be gained by careful tax planning for your specific situation.

The million dollar question is, how do you quantify this? How do you find the optimum amount of capital gains to realize?

I was wondering if you have any tool/calculator you personally use.

Thanks!

David John Marotta

Greetings Skerdi,

Yes, there is a complex computation for capital gains analysis, but the bottom line is that if you don’t need the money for the next few years you are better off waiting to sell until you do. UNLESS you are in the zero percent capital gains tax brackets for 2012 in which case you should take advantage of this opportunity before the end of the year. I wrote in more detail about this topic in my subsequent column, “Capital Gains Tax is an Economic Monkey Wrench (2012).”

Johnathon

Following up on Skerdi Kostreci’s point; one of the most overlooked but useful deductions set to expire is Sec.179 with reductions to deductions, capital purchases, and the end of bonus depreciation.

There are a few other personal finance suggestions I would make:

1) Push unrealized losses into 2013;

2) Manage your earnings and tax-shelter contributions to realize income this year and benefits next year;

3) Where you can, time student loan payments, mortgage payments, tuition, medical expenses accordingly.

Also, I love that you mentioned placing investments in the correct investment vehicles. The number of times I find MLPs and Munis in Roth accounts astounds me. People forget this simple piece of advice and it cannot be reiterated enough.

Regards,

David John Marotta

We have a series of articles on putting the right investments in the correct investments vehicles.

Paul Dyer

Your dead on correct! Planners who sell products without understanding tax planning are going to lose clients to the advisors that do! Gloves are off if you dont step up your game!