Roth Recharaterizations are no longer part of the tax code.

For a description of how this changes this Roth conversion strategy, read “No Roth Recharacterizations After 2017?”

The world of retirement accounts is a confusing tangle of IRS codes. The average family does not take full advantage of the tax laws. They can find financial tax planning equally bewildering.

The world of retirement accounts is a confusing tangle of IRS codes. The average family does not take full advantage of the tax laws. They can find financial tax planning equally bewildering.

A complex technique called “Roth segregation accounts” could earn your investments an extra 30% over the next two years, so you’ll have to study this column carefully to understand how it works. But trust me. Learning about this strategy will be well worth the time.

There are two types of individual retirement accounts (IRAs): traditional and Roth. With a traditional IRA, contributions are tax deductible for middle- and lower-income families and the values grow tax deferred. But as you withdraw the money, you have to pay ordinary income tax rates on it. If your tax rate is lower in retirement when you take the money out than it was when you originally received the tax deduction, a traditional IRA account can offer great benefits.

Upper-income families don’t get a tax deduction if they are an active participant in an employer plan. However they can still contribute to a traditional IRA. Money they put in that didn’t qualify for the tax deduction still grows tax deferred. But when they withdraw the money their tax liability is lower. Imagine they contributed $10,000 that was tax deductible and $5,000 that was not because their income had risen above the limit. After many years their $15,000 contribution has grown to $100,000. When they withdraw the money in retirement, 5% of it is not taxed because of that $5,000 after-tax contribution.

Traditional IRAs are also subject to required minimum distributions (RMDs). Starting at age 70 1/2, owners of traditional IRAs must take a certain percentage out of the account and pay ordinary income tax. The government requires the withdrawals because it wants to start collecting tax on the money. But because account values have dropped so much lately, Congress has waived the RMD in 2009. (The government evidently wants account values to recover to maximize the taxes collected.)

With the second type of retirement account, the Roth IRA, there is no tax deduction when you deposit the money. You must pay the tax on the income first and then contribute to the Roth. And only middle- and lower-income families are permitted to contribute. The investments grow tax free rather than tax deferred. Qualified distributions from Roth IRAs are not subject to any income taxes. Roth IRA accounts are to your advantage if your tax rate is higher in retirement when you withdraw the money than it was when you contributed.

With a Roth IRA, you pay tax on the acorn. With a traditional IRA, you pay tax on the oak. Many families have actually lost money by investing in their traditional IRA when they were young and in a lower tax bracket only to find themselves in a much higher bracket during their retirement. In fact, so much money has accrued in retirement accounts that if it were all withdrawn today, it could pay off a significant percentage of the federal deficit.

In fact, you can do just that. In a “Roth conversion,” you take money from your traditional IRA, pay tax as though that money is ordinary income and convert it to a Roth IRA. Currently only middle- and lower-income families can do this. But the law will change in 2010, allowing families with any level of income to convert to a Roth.

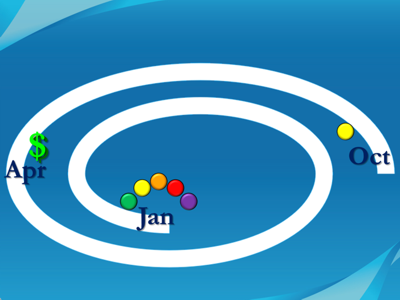

If you execute a Roth conversion in January of year 1, you may not have to pay the tax on that conversion until April 15 of year 2. You also may change your mind. If you decide the conversion wasn’t worth it or you were over the income limits allowed for a conversion in 2009, you can move the money from the Roth account back to a traditional IRA account. This is called a “Roth recharacterization.”

Recharacterizing a Roth conversion can be done any time before you file your taxes, including the filing extension. So you can change your mind any time before October 15 of year 2. And you can decide to recharacterize part or all of what you converted.

In the midst of all these changing tax laws, the tax rates are also in flux. At the end of 2010, the Bush tax cuts will expire. The Obama administration is not expected to alter the rates significantly before then. They don’t want to be blamed for raising taxes before the midterm elections. They would rather implicate the previous administration for a crazy expiring tax law.

Until then, tax rates are at a historic low. After 2010, counting all the tax changes, top marginal tax rates will probably rise from 44.6% to 62.4%. Thus you will only have to pay a maximum of 44.6% on income you can take before 2011, but after that you may have to pay 17.8% more in tax.

The upside is that you can use all these laws and changes to gain an extra 30% on your investments. During the next few years, tax planning and management will be a significant part of wealth management. But it needs to be put together as part of a larger plan.

Here’s the timeline of how to use a Roth conversion to maximize your investments. Early in year 1, do five Roth conversions of equal amounts into five separate accounts. You aren’t going to keep them all, so you can convert five times as much as you want to end up keeping and actually paying tax on. Invest each Roth account in a different asset class (e.g., large-cap U.S. stock, small-cap U.S. stock, foreign stock, emerging markets and hard asset stocks).

The five accounts will appreciate differently, but the entire portfolio will be fairly well balanced. Before April 15 of year 2, decide if you will be keeping only one account or more than one. If more than one has appreciated significantly, you may want to keep more than one account’s conversion. Compute your tax liability for the year and pay the tax, but instead of filing your return, file an extension.

Before the October 15 extension deadline, decide which of the five accounts you are going to keep. By now, nearly a year and three quarters has elapsed. You can easily determine which account has appreciated the most. Keep that one and recharacterize the other four. Because you only have to pay taxes on the amount you originally converted, it’s like betting on the horse race after the winner has already been determined. After recharacterizing the accounts, file your tax return before the October 15 extension.

If all of the accounts decrease in value, recharacterize them all and pay no tax. Financially you are none the worse for having filled out a folder of paperwork. If only one account appreciates significantly, you only keep one conversion. But you have increased the odds of your Roth account going up by five times.

The average return of the S&P 500 is about 11%, but the standard deviation is about 19%. All of the other asset classes have an even higher standard deviation. It is likely, for example, that emerging markets will be either the best or the worst performing asset class over any two-year period. Using this technique you can guarantee that the Roth conversion you keep will have been invested in the best asset class during that year and three quarters.

Segregating each of the five conversions into a separate account allows you to decide to recharacterize or let each account stand separately. The difference in returns between the average and the best account is liable to be 20% or more over the year and a half before you have to choose which accounts to keep. Coupling the 17.8% tax savings and this Roth segregation technique could boost your returns by 30% or more.

In the quite likely event that all five accounts have appreciated significantly, you may decide to keep them all. Once you have reached the maximum tax rate, the top marginal rate does not increase from there. Those most fearful of expectations of higher tax rates soaking the rich after 2010 would be those most likely to benefit from converting everything.

If you are under the threshold for Roth conversions for 2009, you can start this year. This is especially appropriate for people older than 70 who are forgoing their RMD withdrawals. At least convert the same amount as you would have been required to withdraw anyway. Better yet, convert five times that amount in five separate accounts and keep the one which performs the best.

If you are over the income limits for Roth conversions this year, those limits go away next year. You can convert in January 2010 and you’ll have until October 15 of 2011 to decide which accounts to keep and which accounts to recharacterize. If you do not qualify to make either Roth or deductible IRA contributions, you can still contribute $5,000 to a traditional IRA for 2009 even though you are ineligible for any deduction. Contribute another $5,000 in the beginning of 2010. Then immediately convert the entire $10,000 to a Roth IRA in 2010. If you do not have any other traditional IRA accounts, you will only have to pay tax on any growth over the $10,000 you contributed but for which you received no deduction.

As if tax matters couldn’t get any more complex, Roth conversions during 2010 are taxable 50% in 2011 and the other half in 2012 unless the taxpayer elects to have them taxed completely in 2011. Generally, with rising tax rates, paying the tax in 2011 could be best, but individual situations may warrant spreading the tax over two years.

Even thought this technique could boost your after-tax returns by as much as 30%, be careful. Executing a Roth segregation account requires professional assistance. Such a technique should be just one small part of a larger comprehensive financial plan. And you should seek the guidance of a personal fee-only financial planner and certified public accountant (CPA), who have a legal obligation to act in your best interests. The laws are changing annually, and as a result so is the optimum path.