Q: I’m turning 45 this year and the reality is hitting me that I am now about halfway through my working career. I have $275,000 saved in a 401(k) plan and another $125,000 in a traditional IRA. Going forward, I plan to save the maximum amount in my 401(k) every year. Am I on track to retire at age 65?

Sincerely,

Cresting the Hill

$ ?s answered by Matthew Illian, CFP®

Dear Cresting,

By midlife, everyone should schedule an annual physical with their doctor and routinely assess the state of their financial health. With regular retirement checkups, you can make small course corrections now rather than delaying until a small problem has ballooned beyond your control. I would need additional background information to address your specific situation in detail, but I can share some helpful rules of thumb.

It’s best to measure your progress in after-tax dollars. When the time comes for you to pull your money out of your 401(k) and traditional IRA, you will have to pay taxes on this money. By subtracting 30% from your current retirement plan total, you are left with $280,000.

Your progress toward retirement is entirely based on the standard of living to which you’ve become accustomed. So if your friends call you “Gucci” now, you likely need to accelerate your retirement savings plans! You can quickly measure your standard of living by starting with your income and subtracting savings and taxes. If you make $85,000, save $10,000, and pay taxes of $10,000, your standard of living is roughly $65,000.

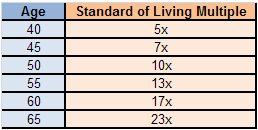

By age 45, you should have seven times your standard of living. So if your standard of living is $65,000, your after-tax retirement savings should be just over $455,000. If you expect to receive an inflation adjusted pension benefit of $20,000 a year, subtract this amount from your current standard of living. So at $45,000 ($65,000 minus $20,000), your target retirement savings at age 45 should be $315,000 in after-tax dollars.

You can retire in comfort at the point you have saved 23 times your income needs. At this point you can begin to live off 4.36% of your savings, which is the percentage that can be safely withdrawn from a cost-efficient and diversified retirement portfolio without fear of outliving your savings. If you want to know “your number,” multiply your desired lifestyle by 23.

Annually saving 15% of your standard of living is a good benchmark simply to stay on track toward meeting your retirement goals. Getting serious about those goals means you must begin to think of yourself as a supersaver. If you see that you need to catch up, you will want to target a 20% or 25% savings rate.

Financial checkups are key to a healthy and secure retirement. Your lifestyle and savings decisions will have an ultimate impact on meeting your retirement goals.

Find your inner supersaver today!

If you have a money question that is nagging at you, please submit it using our contact page. We attempt to respond to every question. If yours is chosen for MONEY QUESTIONS, we will give you a pseudonym and let you know the date the Q&A will be published.