With three young energetic boys, the growing costs of college education weigh heavily on my mind. As a financial advisor with a reputation to keep up, ignoring these pending expenses is not an option for our family. Each year, I share the age-based benchmarks we use to ensure that our 529 college savings is on track to meet our goals.

For a child born today, expect the four year costs of tuition, room and board, and books (not the paper kind we grew up with) to run at $202,211 based on average in-state tuition rates and a 5% annual increase. Reaching this goal requires a monthly savings of $461 from the day a prospective college student is born on top of the returns you can expect from a savvy investment asset allocation. Private institutions charge approximately twice this amount.

Parents have many different philosophies when it comes to preparing for college. Many of those who are financially capable do not hesitate to foot the entire bill, but I think these parents are making a mistake. I see great value in having my children share in the cost of their education.

I am not going to let them take on a crushing amount of college debt. But I’m also not going to let this opportunity to think long and hard about opportunity cost pass us by. No matter how much you plan to contribute, including your children on the financial realities of college is one of the more important lessons learned from their college experience.

My wife and I have decided to use in-state college expenses to target our savings. Virginia offers our children a robust list of high quality colleges and universities which have been subsidized by our tax dollars. If our children want to go out-of state, I’m planning to let them know that they will need to find a way to cover the difference.

We’re planning to save 75% of these projected in-state costs by the time they graduate from high school. Our kids can cover their share with scholarships, summer jobs or subsidized loans (if Sallie Mae hasn’t gone belly up by that point). Through some combination of natural talents and a strong work ethic, I don’t expect they’ll have any problem making this investment.

If it turns out that a college considers our boys as talented as I do, we may not even need all the money that we’ve saved. You may not know that you can finance your own retirement with any money not used up in college savings plans. The penalties imposed by taking money out of a college 529 savings plan are a wash when you factor in the tax-deferred growth of these plans. In fact, any scholarships your children receive will allow you to take money out of these plans without any penalty at all.

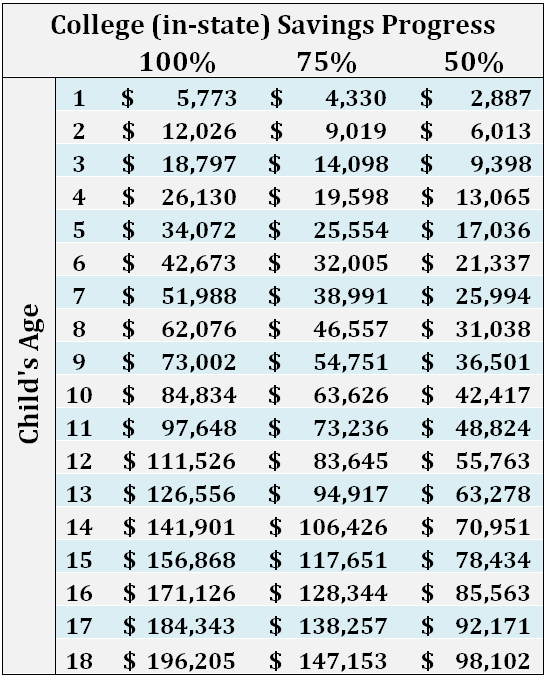

You can use the following progress chart to see if you’re on track to meet your college savings goals:

Parents following our 75% plan should have saved $25,554 by age 5 and $63,626 by age 10. The 75% college savings plan suggests a monthly savings rate of $345 per child from the day they are born. The 50% plan requires $230 per month/child. As I mentioned earlier, you can estimate private school costs by doubling these numbers.

The value of my college experience becomes clearer each year, and I have a strong commitment to help offer this opportunity to my children. I expect that advanced learning and networking will become even more critical in their future. If you have young children and haven’t started saving for their future college costs, make it a priority to begin a 529 savings plan today. Preparing for our children’s college expenses, or at least 75% of them, is a sacrifice well worth making.

Photo used here under Flickr Creative Commons.