As college costs continue escalating, many gladly welcome help from family. With savvy planning, grandparents can ensure their gifts are not impeding a grandchild’s ability to access financial aid.

The traditional financial aid assessment tool used by the Department of Education to award grants and loans is called the Free Application for Federal Student Aid (FAFSA). The FAFSA determines a family’s eligibility for financial aid by counting certain income and assets towards their ability to pay college costs.

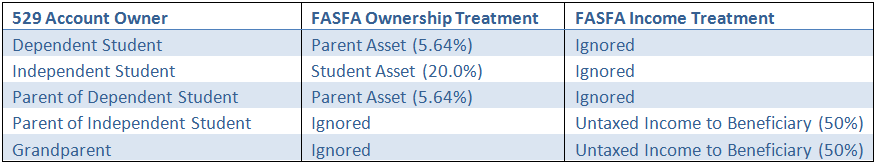

Under the FAFSA, grandparent-owned 529s are not counted in the formula but any distributions are counted as income in the following year. If a grandparent uses a 529 to pay a $12,000 tuition bill, the following years’ grant and subsidized loan eligibility will be reduced by $6,000. Ouch! The same 50% penalty occurs if a grandparent gives money to a college-age grandchild or pays their tuition bill directly.

Those students who qualify for financial aid can be best helped by considering one of the following strategies:

Wait Until The Last Three Semesters

A grandparent’s 529 distributions will not be counted by the FAFSA if these gifts are made after January of a student’s junior year. However, this strategy needs to be recalculated if your progeny takes a little longer than most or continues on to graduate study. If grandparents want to help, it’s best to save assistance for the final laps.

Transfer Each Years’ Funds To A Parent

If a grandparents’ plan is to help out with more than just three semesters, they will be better off transferring enough 529 funds to pay for that years’ qualified expenses. Using this method, only 5.64% of the payment will count against financial aid eligibility on the FAFSA, rather than 50%.

To do this, the parent will need to open a 529 account and receive this transfer before the FASFA is filled out. If the transfer comes afterwards, money received but not counted as a FASFA asset will be counted as student income and be subject to the nasty 50% rule.

Help Pay Loans Off After Graduation

Student loans offer a important dose of financial reality for some students, but too much of a burden is crushing. Some grandparents will choose to let their grandchildren make it through the college years on their own and then help to lessen the load after the college years are complete.

A more robust student aid calculator called PROFILE is now used in addition to the FAFSA at over 350 elite colleges and universities to manage their own financial aid. In addition to looking at assets and income, the PROFILE questionnaire asks if a student expects to receive any additional income to pay for college expenses. In this case, it’s better not to make any promises to grandchildren that they may need to report.

After reviewing these rules, some families decide that it is worth their time to pay for a professional consultation to select the best strategy to pay for college. Whichever path you choose, make sure to review these plans with your grandchildren. Teaching them the value of financial literacy in a world of added complexity is one of the more important investments you can make.

Photo used here under Flickr Creative Commons.