Social Security benefits can represent a big stack of cash. A typical monthly benefit of $2,200 has a present value well over $500,000. Consider all your Social Security options carefully to avoid making a costly mistake.

Like all government law, Social Security is not a simple piece of legislation. Since the Social Security Act became law in 1935, hundreds of amendments have added to the complexity. To make the best decision, you must consider health, income before retirement, income during retirement and taxes.

Retirees cannot rely on commonly held beliefs. Don’t assume that simplistic rules such as “Always file for early benefits” or “You need to stop working to receive benefits” are correct. Specific cases break every rule of thumb. And these one-size-fits-all answers leave many retirees failing to maximize the benefits they have earned.

The decision is even more critical for women. For 42% of single women older than 62, Social Security is their sole source of income. Women on average outlive men. Thus planning for retirement is much easier for men, who tend to have more assets and die young. Widows are twice as likely to live under the poverty line as men who have lost their wives. And the poverty rate for elderly single women is 23% compared with just 5% for retired couples.

Couples must take their joint longevity into account before either one files for benefits. The person with the longer life expectancy will inherit either a wise or a foolish decision that will last a lifetime. Given that a husband’s benefits are often higher and the wife’s life expectancy longer, each case needs to be analyzed carefully.

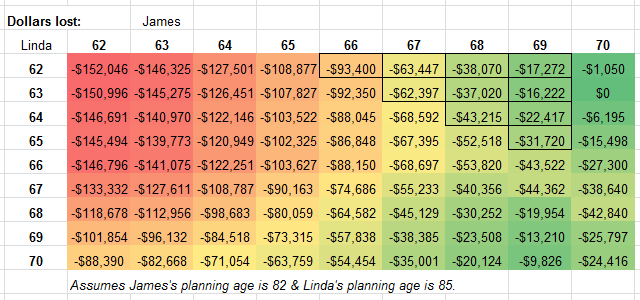

Consider for illustration the case of James and Linda Miller. James was born in 1950 and is turning 62 this year. He will receive $2,384 a month at age 66, his full retirement age. Linda is three years younger and expects to receive a smaller benefit.

About three quarters of Americans file for Social Security benefits before their full retirement age. This mistake is statistically most costly when the husband chooses to begin claiming at age 62. In this case, such a mistake would cost the Millers $152,046 in lifetime income.

Assuming normal life expectancies, Linda should file for benefits at age 63. James will be age 66 at that point and have the opportunity to pursue an often overlooked Social Security loophole. He can choose to file only for his spousal benefit and delay filing on his own benefit until age 70. We call this “File as a Spouse First,” or “FAASF.” You can see the results of this optimal strategy listed in the table. Each box represents the amount of total lifetime benefits that would be sacrificed if James and Linda did not file at their optimal ages.

The box representing when Linda is age 63 and James is age 70 captures the highest lifetime benefit. The highlighted box represents the ideal age combination when James is eligible to begin collecting his FAASF benefit while delaying his personal benefit.

Unfortunately, many people file after considering only one or two isolated options. The Social Security Administration’s new online filing system enables quick decision making. People can easily submit their request without any professional advice or planning.

But before filing, you obviously should be informed about all the options. To begin, you need to know your personal Social Security earnings and the projected benefits for both you and your spouse. You can request an estimate at www.ssa.gov/estimator and then print the results. Or call the Social Security Administration at 800-772-1213. For a general review of Social Security, start by reading “Retirement Benefits” (Publication No. 05-10035) online.

Social Security planning is crucial for everyone. People with significant assets should carefully consider both the lifetime benefits and tax consequences of Social Security in light of their overall portfolio strategy. For the less well off, Social Security benefits will dictate their retirement lifestyle. Proper planning could well determine what they can afford to eat.

We are offering an hour-long free seminar, “Get More from Social Security (Up to $250k),” as part of the NAPFA Consumer Education Foundation this Wednesday, March 14, 2012, at 5:30 p.m. at the Charlottesville Senior Center. We will help you understand your options before you file as well as how to correct your filing if you have already locked in the wrong choice. A question-and-answer session will follow.

Subscribe and receive free presentation: Social Security: How to Get $250,000 More!