Most Americans fail to plan adequately for retirement and consequently miss out on opportunities to enjoy the last third of life. The best and most rewarding financial planning is not just about the numbers but rather takes place in the context of personal goals.

Most Americans fail to plan adequately for retirement and consequently miss out on opportunities to enjoy the last third of life. The best and most rewarding financial planning is not just about the numbers but rather takes place in the context of personal goals.

Retirement used to mean not only a complete withdrawal from the workforce but often a retreat from life. Even the word “retire” has the connotations of shuffling quietly off to bed.

We call that traditional concept a “cliff retirement” because it is so abrupt. One day you are working full time, and the next you are playing full time (or slumped in your chair watching TV feeling unwanted and over the hill). We all need meaning and significance in our lives. And close social relations are an intrinsic part of our humanness. For many people, work provides meaning, significance and social relationships.

Try this retirement planning exercise. Draw a large circle and write the names of 10 people inside the circle who you are genuinely close to. Don’t include any relatives. They have to love us, and although our connections with our families can be very nurturing, it is friends who help validate us and widen our horizons.

Now cross out any of the 10 names you know through your work, which might eliminate half or more of the people you listed. Thus a cliff retirement can devastate not only your meaning and purpose but your social network as well. Retirees who no longer work at all say their close friends dwindle to an average of about nine people.

As a result of their isolation, people who opt for a cliff retirement often deteriorate quickly and die relatively young. Financial planning is easy when you die young, but we don’t recommend it. Here are some suggestions to consider as you approach what is traditionally considered retirement age.

Consider postponing retirement. Delaying retirement until age 70 increases your Social Security benefits and also shortens the time you will be withdrawing from your portfolio. It gives you additional years to save and your portfolio more time to grow. By delaying retirement from 65 to age 70, you may have more than a 50% higher standard of living when you do stop working.

Or instead of taking a cliff retirement, think about retiring gradually. Move from full time to 30 hours a week, and then to half time. With this less hasty transition you can maintain contact with the people and purposes that give your life meaning and also have the time to develop goals and a network of relationships for your later years.

Envision your final years not as retirement but as financial independence. Now that you don’t need to work exclusively for money, make a list of activities where you would like to focus your energies and use your skills and experience.

Consider developing a health and fitness routine. If work kept your mind and body engaged, you will need to replace that activity with other pursuits. Again, going part time allows you the luxury of processing the transition and adjusting to a new lifestyle.

Challenge and reexamine those stereotyped and overly rigid assumptions about retirement. Two books that may help you tailor your retirement to be a productive and satisfying time of your life are “Encore: Finding Work that Matters in the Second Half of Life” by Marc Freedman and “The New Retirementality: Planning Your Life and Living Your Dreams….at Any Age You Want” by Mitch Anthony.

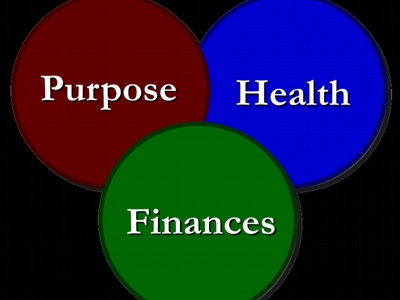

Of course crunching the financial numbers is critical as you begin to contemplate retirement. But your personal calling, support network and health and well-being are just as important. In the end, a holistic approach to your life is always the best starting place.

We offer just such an approach every year through the Osher Life Long Learning Institute at the University of Virginia. Beth Nedelisky and I are teaching the workshop “Planning for Success and Significance in Retirement.” The course, intended for people age 50 to 70, covers cash flow projections and asset allocation as well as meaning of life issues. The three-week course begins Thursday, March 10, from 11 a.m. to 12:30 p.m. at Meadows Presbyterian Church. You may register online (virginia.edu/olliuva) or at the first class.