We have written before about the advantages of donor-advised funds. But there are multiple companies that offer these funds. Which company should you choose? While we don’t have room to go through all of them, here we compare three large brokerage companies that offer funds for the charitably inclined, Charles Schwab, Fidelity, and Vanguard.

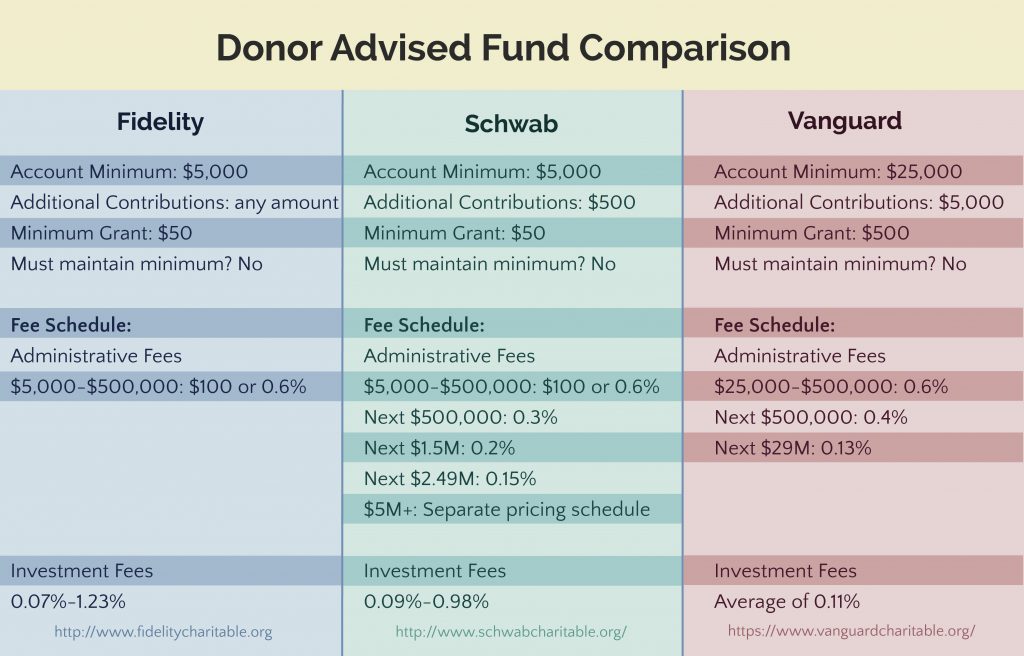

Schwab and Fidelity seem fairly comparable, with account opening minimums of $5,000. Vanguard, meanwhile, is targeting a different group of philanthropists, with a $25,000 minimum to open an account.

Schwab and Fidelity are also fairly comparable when it comes to administrative fees for accounts up to $500,000. Higher account values are slightly cheaper at Schwab, as they give price breaks at $1,000,000 and above, while Fidelity keeps their rates at 0.6% of assets in the account, regardless of account value.

Vanguard also gives price breaks at $1,000,000 and above, which are slightly less favorable than Schwab’s rates.

Once your account is set up, Fidelity allows additional contributions of any amount, while Schwab has a minimum additional contribution of $500, and Vanguard’s is $5,000.

Giving money away to other charities is called a grant. Schwab and Fidelity have minimum grants of $50, and Vanguard has a minimum grant of $500. After establishing an account, you are not required to maintain a particular balance, but the hope is that you will continue to contribute and give money away to charities through these donor advised funds.

One of the advantages of a donor-advised fund is to contribute when you want to contribute – which might be in a large chunk all at once – and then you can make grants later in smaller amounts to several charities. This allows you greater flexibility and is easier for many charities, especially small ones that might not have a stock liquidation account. Receiving a check from a donor-advised fund is much easier for them to process and put to work.

If you plan to keep money in your fund for a while before making grants, you may want to invest to allow your contributions to grow or at least keep pace with inflation. Schwab’s investment expense ratios range from 0.09% to 0.98%, Fidelity’s investments range from 0.07% to 1.23%, and Vanguard averages 0.11% (depending on what Vanguard fund you choose to invest in).

Vanguard funds are the cheapest to invest in, but the account requires the most initial investment, and does not allow you to contribute small amounts to charities.

All of these funds are good options for the charitably inclined, so choose the one that fits you best.

Photo used under Unsplash Creative Commons Zero license.